Introduction

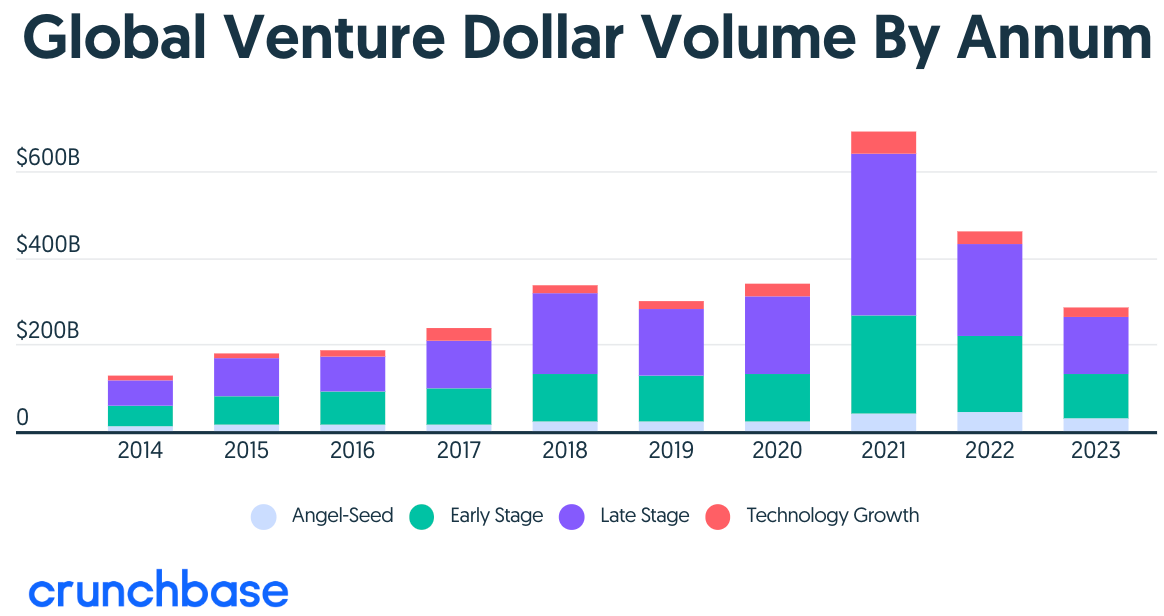

From 2021 to 2023 startup fundraising from venture capitalists went from $621B to $285B and the number of emerging VC managers who were able to raise a second fund sank significantly. From 2018 to 2022 1,100 new funds launched with 307 starting exclusively in 2021, but by 2022 only 100 were able to launch the entire year. One rationale is that 26% more money went to funds with $1B AUM or larger in 2022 than in 2021, redirecting LP money from ‘risky’ emerging managers.

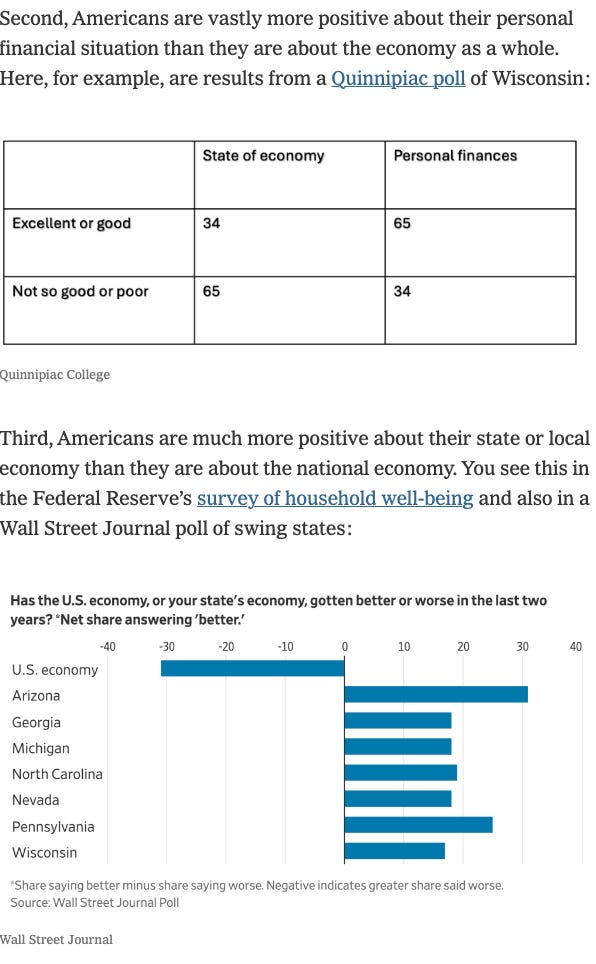

These realities are just some examples of public market and overall consumer hesitancy. This is even though the US economy was growing at a steady rate of 3.4% in Q4 2023 with a lower than average unemployment rate (3.6% in 2023 compared to 4.10% in June 2024 as more people start to look for jobs), and a higher yet manageable rate of inflation at 2.97%. In spite of these numbers consumer sentiment on the economy is poor with many Americans believing that we are in a worse position economically than we actually are as a nation. This is though comically most believe their local economy alongside their personal finances are doing favorably (Appendix A below). The effects of this tension is not just noticeable from a macro perspective, but also personally. All of us at Associated know at least two people who have been impacted by tech’s 2023/2024 mass layoffs, which were in part due to public market downturns and investor hesitancy. Without question, the lie down movement of 2021 and 2022 is over and we are feeling the aches of the juxtaposition between US mass sentiment and reality.

Soooo given these bigger market shifts what’s been up with us I hear you say? Or maybe you didn’t ask, but we’re going to tell you anywho! Since we paused the podcast (but some of us have released audio content here and there!), we now miss the more collaborative aspect of our work, so today we’re back together to talk through how, what is happening in the market has impacted us and our career. A little catch-up if you will.

Quick plug - If you’d like these to be more frequent please join us at our first in person event on September 3rd [register here]. We’d love to meetup and opine. Now back to our points of view, which are written below.

What is Top of Mind for Us:

DB:

Given the amalgamation of strange happenings following the startup ecosystem over the past few years, one may assume that founders would seek stability today more than ever. Them building something new, maybe also in a new or underserved market, should be enough to make them yearn for non-variability in all other areas of their lives (for ex. Where they live and where their company is based). However, that doesn’t seem to be the case. What I initially thought was just a coincidence of European born and based founders, incorporating in the US in record numbers, is not one. Also, my gut feeling is not just based on being an American born and based investor, but also based on my time working in Europe’s tech ecosystem on two separate occasions. Having had the opportunity to live in both Berlin and London alongside the Middle East and Asia, I feel like I am uniquely positioned to follow my gut in comparing the two ecosystems.

In 2023, though Europe continues to outpace the US in terms of companies founded, the number of European entrepreneurs deciding to co-incorporate or just incorporate their startups in the US is on the rise. In 2023 Index Ventures even published a book “Destination US” for European and Israeli founders on how to move to the US, after having supported 40 European tech companies in their US expansion. From Index’s perspective most of them did it mainly to obtain customers. This movement is not a wild phenomenon to me as the US has one of the most flexible and legally vanilla incorporation setups for startups. It also has historically allowed early stage companies to raise financing at better valuations with overall more founder friendly terms. Moreover, if a company decides to go public, it is becoming less and less feasible from a legal and financial perspective to be publicly listed in two exchanges at the same time. In the US, at least companies can participate in equity indexes, which allow them to potentially be placed alongside higher valued US companies in the public market asset, increasing their potential earning power. Lastly, the US also lowered their investment funding in Europe in 2023 going from 39% to 25% in one year. So though the movement of non US founders incorporating there is not confusing, I was startled by the fact that this movement doesn’t seem to be affected by industry domain.

Given Europe’s support of ‘breakthrough’ technologies through vehicles like the European Innovation Council (EIC)’s fund, which deployed over €165m in grants in Q1 2024 alone across 68 companies, and the European Innovation Council Accelerator, which can give an ‘innovative idea’ up to €2.5m in non dilutive funding, why every type of startup founder is incorporating in the US starts to raise more eyebrows. Especially as doing so makes European grant money less accessible to US based teams. Also if there is anything I know about asset heavy businesses - it is that sooner or later they typically need government funding or at the very least, government support, so why bite a hand that is offering you a feast? The only reason I can think of is that today the potential customer, public market and favorable valuation potential decidedly outweighs the early stage grant money prospects in Europe. These pulls to the US are enough to justify getting investors as early as the friends and family round from the US for what would traditionally be a European incorporated startup. I have been a part of two rounds this year way earlier than I thought!

Being the daughter of a hardware founder as well as a college entrepreneur who worked on an asset heavy business and studied complex systems, I am interested to see how the plans these companies make today affect their business model and fundraising strategy tomorrow. I hope their calculations are correct and these earlier cross Atlantic moves only work in their favour. A take away from my reflection is that, despite all of the U.S.’s continued qualms, we still seem to be the place to be for all high growth startups. At least for now…

Francesca: A divided industry

Reflection, by its nature, is inherently biased as it draws from personal experiences. However, hard facts often reveal that factors beyond our control significantly shape many destinies the same way. Investors (both public and private) can significantly influence the future of people, companies and industries by providing substantial capital and resources that fuel technological and trend advancements. For example, we are seeing fewer companies IPO (1,035 in 2021, 181 in 2022, 151 in 2023, 98 in 2024 to date),and less capital invested into Venture Capital (VC) deals than in previous years meaning, in general, the tech ecosystem has been donned more conservative in recent years meaning capital is comparatively less available. However, there are still some vast fundraising rounds happening to the select lucky few, take these funding rounds this year for example:

Figure, a robotics company, founded 2019: raised $675 million (series B)

Helsing, a defence company, founded 2021: raised €400 million (series C)

Moonshot AI, a LLM company, founded 2023: raised $1bn (series B+)

Minstral AI, a LLM company, founded 2024: raised $500 million (series B)

Zepto, a Q-commerce company, founded 2020: raised $665 million (series F)

Average ticket of top percentile company: $648 million

Interestingly, between Q4 2021 and Q1 2023, the median Series B round size on Carta fell from $30 million to $12.3 million, subsequently, these big fundraising rounds highlight the expanding gap between the top percentile (see above) and the median.

This divide is not the only one we see in the tech ecosystem. A bittersweet advancement over the last years is that the vast amount of data at our fingertips provided by the likes of Crunchbase and Pitchbook on private market investments, can help us identify inequalities easier than ever before. For example, a 2023 McKinsey report shows that only 1% of VC funding goes to Black founders, 1.5% to Latino founders, 1.9% to women-founded teams, and just 0.1% to Black or Latina women-founded teams. This could be in part because women represent only 13% of decision-makers in VCs with a staggering 66% of investment teams having no women decision-makers. Unconscious bias influences our decisions more often than not and what has been proven time and time again is that people are more comfortable in investing in what and who they know.

I understand that the VC game, by its very nature, consists of a few big winners and many ‘losers’. However, over the years, external PR messaging from the VC world has projected that equal opportunities and/or the needs of people and the planet are the primary focus when making investment decisions. When looking at data from the lens ascribed above, it is clear that the VC ecosystem as a whole in fact prioritises in the following order:

a) returns first

b) purpose second

This order is unlikely to change overnight based on the intrinsic economics that serve as the foundations of industry and furthermore, history tells us that the more conservative the market, the more weighted a) is to b).

Although I have found no clear way of at least closing the gap between these priorities - I am not convinced that the growing number of micro-funds only investing in underrepresented founders or unsexy niche sectors is the ideal solution as the chances of succeeding in raising massive subsequent rounds are so low due to biases - so how can companies/founders truly compete? To put it into an astonishing perspective, the two big funding LLM-company rounds this year equate to more than the sum of all clean water tech companies (55 received a total of $1.2B in funding) last year. On this point, one could argue that the total amount of companies invested in a sector is a better reflection of the interest in the industry than the biggest funding rounds into individual companies. However, I suspect that founders and VCs would argue that to be successful, often requires a market monopoly and having more capital to deploy certainly helps beat out competition (more runway, the best talent, more marketing expenditure) - in short the system is intrinsically not fair.

VC is a brilliant industry full of innovation and dynamism and can act as a tool to drive change, I wish in the next ten years for policy and regulation makers to enforce change around the distribution of capital across different GP and founder profiles, and investing more towards SDG goals and to clamp down hard on ESG reporting. But perhaps the most influential cause for change will be that a new generation of investors (importantly both private and public) will come through whose investment lens differs from the previous generations. I think I started my career at the beginning of this wave and although it is coming, it is likely to take time to for the purpose PR messaging to catch up with where the money is actually being distrubted, even more so when the macro-market’s conservative ‘stick to what we know’ nature comes into play when economies take a downturn.

Tunde:

I spent 2021 quietly praying for things to change. The market felt so different from just two years prior when I got my first role in VC. There was something wrong with how we were acting as an industry - but I couldn’t quite put my finger on it.

It all crystallized when I saw a company raise a pre-seed round and then six months later raise a $7m seed. Between these two fundraises the company had done nothing but hire a few people and get a Forbes article. But neither this lack of progress nor the size of the round are what shocked me...

What shocked me was that their pre seed investors were celebrating. These people were celebrating having to put in an additional €1.4m in a company that was no closer to being a real business than it was when they first invested in it. They were celebrating paying €1.4m for the same thing they had bought for €600k.

If you had asked these investors whether they would pay $2m to invest in this business six months prior - I'm certain they would have told you that you were crazy. Yet here they were, popping champagne at the prospect of overpaying for the same thing six months later, simply because someone else wanted to do it. That's what broke my brain.

I spent a lot of time secretly wishing that the venture industry would return back to earth. However, now that it's happened, part of me regrets my wish coming true. Since 2022 VCs have become allergic to risk - hurting founders and likely their own fund performance. We returned back to earth but then we started digging.

We're in an era where VCs, whose whole model revolves around looking at what the outcome will be if things go right, don't pay much attention to upside unless the founders are from central casting or building in the 'right' space. For everyone else fundraising has become an extreme sport.

I think the current state of affairs is much worse for founders than the era I used to sulk about because at least back then the best companies got funded. Moreover, I think that the general negativity is one of the reasons we're seeing increasing numbers of investors getting jaded and leaving the industry. From personal experience, I know that it's extremely painful to see a company you can see performing as an insider go bankrupt because investors are scared. And this pain is being felt all over the market by VCs who were once - just like me - praying for the market to change.

…

So is any of this top of mind for you? Do you have a story you’d like to tell in theme? If so, highlighting the space we are creating for us on September 3rd again. Feel free to bring your friends in tech ++. Let’s converse together.

- x Associated (a.k.a. Francesca, Tunde & Danielle)

Appendix A